In a scheduled announcement on Wednesday, June 5, 2024, the Bank noted Canada’s economy picked up in the first quarter of 2024 but still came in weaker than anticipated. While growth in consumer spending, business investment, and the housing market remained solid, the Bank once again made note of the fact that employment has been rising at a slower pace than working-age population growth.

The Bank continues to focus on elevated shelter costs as a significant contributor to inflation. However, it also noted that both headline and core measures of inflation are showing signs of downward momentum and are close to historical averages.

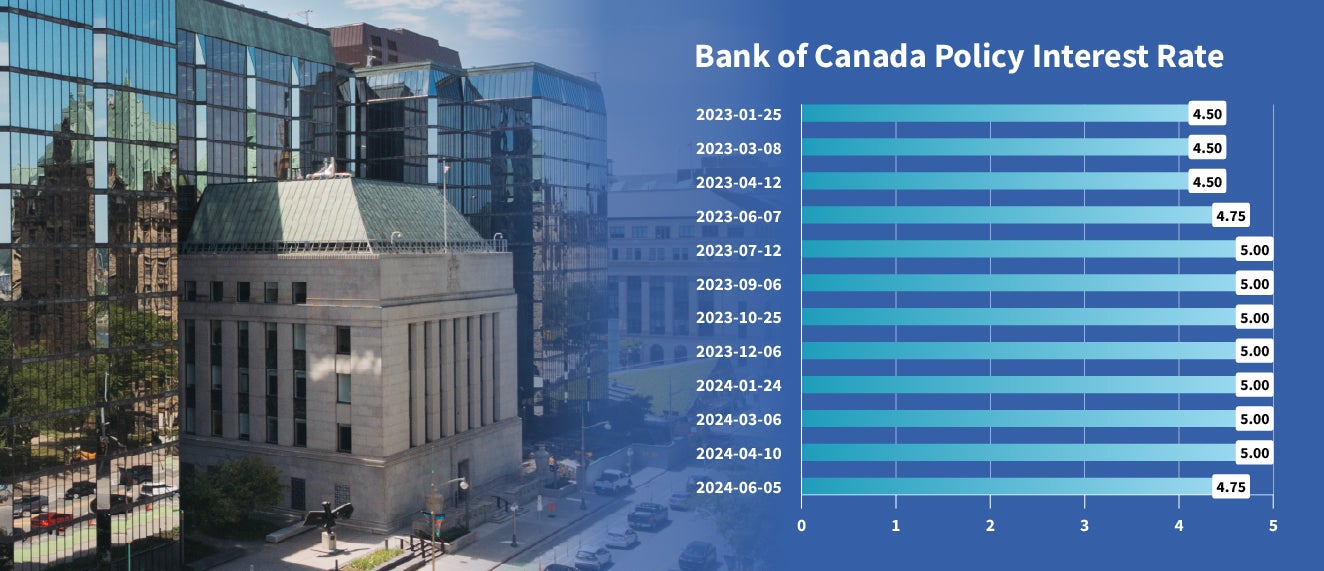

With inflation now back in the Bank’s preferred range of 1-3% and increased confidence that inflation continues to move toward its 2% target, the Bank stated, “monetary policy no longer needs to be as restrictive” in its decision to lower the policy rate by 25 basis points.

The Bank of Canada’s will make its next scheduled interest rate announcement on July 24, 2024, as well as publish its full outlook for the economy and inflation in its next Monetary Policy Report.

Original article from creacafe.ca