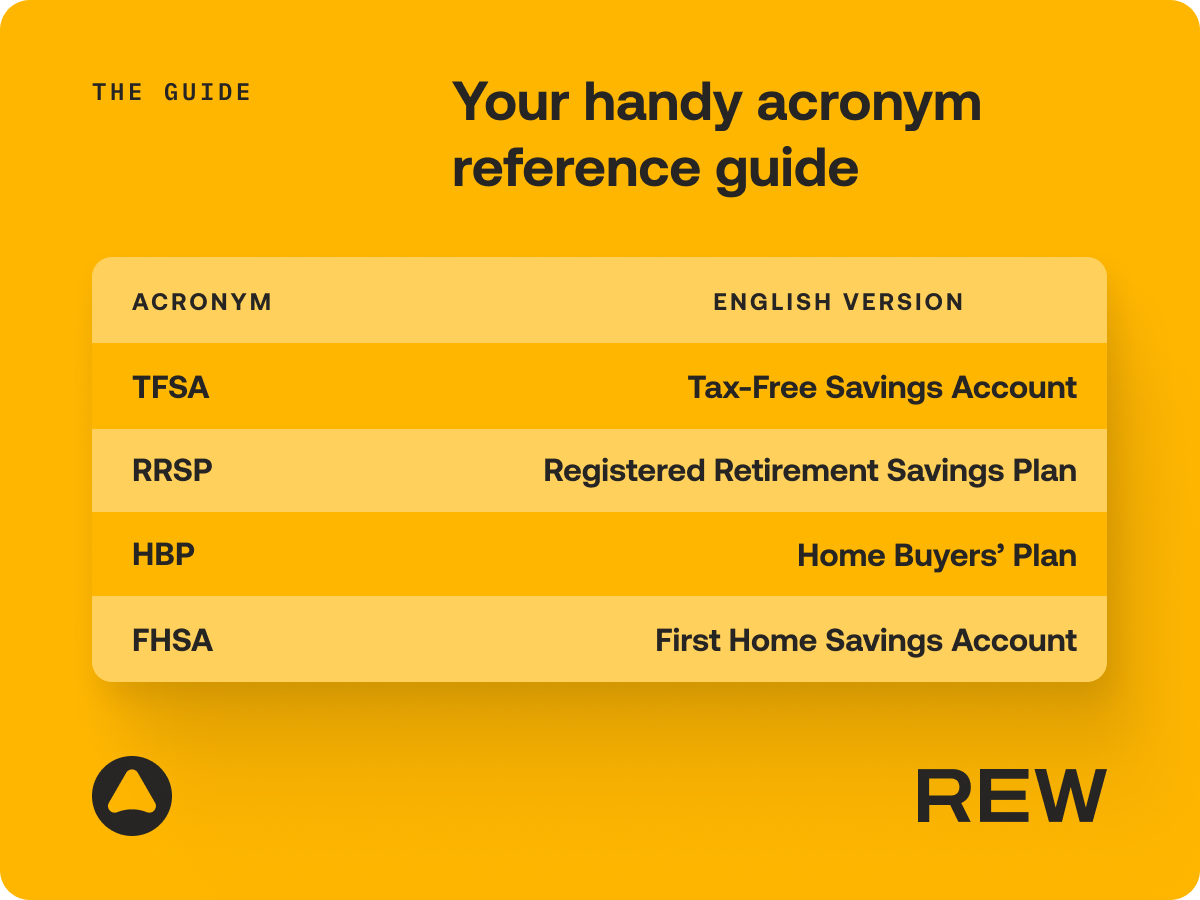

TFSAs, RRSPs, HBPs, and now FHSAs. No, these aren’t Wheel of Fortune final puzzle letters, or letters to work into your Wordle strategy (are people still playing Wordle?). These are savings plans, and one of these four is not like the other. Mostly because, well, it’s brand-spankin’ new.

If reading all of those acronyms induced more anxiety than the latest episode of The Last of Us, don’t panic. We’re here to explain the First Home Savings Account in plain English, with some expert insights to help guide you home.

Every little bit helps.

On April 1, 2023, saving for a down payment is going to get a little bit easier for prospective first-time home buyers, 18 and over. The Tax-Free First Home Savings Account (FHSA) lets first-time home buyers save up to $40,000 tax-free. Even better, if you're coupled up, you can both start saving for that white picket fence dream. So grab your savings jar (or old piggy bank) and get ready to make your down payment dreams a reality.

Alphabet soup.

So how does the FHSA differentiate from other savings plans, such as a TFSA, RRSP or the Home Buyers’ Plan (HBP)? CPA Canada’s Vice President, Tax Department, Bruce Ball, explains it like this: “Like registered retirement savings plans (RRSP), contributions to an FHSA will be tax deductible. Like tax-free savings accounts (TFSA), income and gains in your FHSA, as well as withdrawals, will be tax-free.”

Ball went on to explain that with the current HBP, you can withdraw up to $35,000 from your RRSP, then pay back the funds to your RRSP over 15 years. However, with an FHSA, unlike the HBP, the funds do not need to be paid back. That’s a lot of savings in your pocket. Keep in mind, the maximum amount you can contribute to your FHSA is capped at $8,000 a year to a maximum of $40,000 over a 15-year lifetime term.

Pay it forward.

Like an RRSP, you can carry forward unused contribution room in your FHSA up to $8,000 of your unused annual contribution amount to use in a later year. For example, if you open an FHSA in 2023 and contribute $5,000, you can contribute up to $11,000 in 2024. Carry-forward amounts do not start accumulating until after you open an FHSA.

Trade your heart out.

As far as what you can invest into your FHSA, it is the same as for TFSA - mutual funds, publicly traded securities, government and corporate bonds, and guaranteed investment certificates.

The best choice of savings plans to choose from depends on different factors, such as timing and the potential amount that will be saved. The withdrawals under both plans (HBP and FHSA), can be made tax-free, but since you will have to repay the HBP withdrawal, it appears to make sense to contribute to an FHSA first. According to Ball, if savings are available after FHSA contributions, then making contributions to an RRSP with a view to later use the HBP may be the preferred option.

“Before making additional RRSP contributions to fund future HBP withdrawals, consideration should also be given to using a TFSA to save money beyond the FHSA,” says Ball. “Where a choice must be made as there will be insufficient savings to do both, you’ll need to consider the benefits of each alternative. Although TFSAs are not specifically designed for first-time home savings, these plans are worth considering for several reasons.”

The fine print.

When it is time to purchase your home, Ball says: “You must have a written agreement to buy or build a qualifying home before October 1 of the year following the year of withdrawal, and you must intend to occupy the home as a principal place of residence within one year after buying or building it.”

Benjamin Brock, RBC senior financial planner agrees, adding: “You have to buy a home within that 15-year window or until the end of the year you turn 71 years old. Individuals will be able to claim an income tax deduction for contributions made in a particular taxation year. The FHSA is a great option, as it achieves a few goals that didn’t exist before.”

Welcome to the neighbourhood.

Brock believes that this news is a welcome incentive given Vancouver’s housing prices have been rising for years, while average incomes have been lagging behind inflation rates, presenting an affordability crisis in which many young people struggle to save up enough for a down payment.

“The FHSA is an easy way for prospective home buyers to save money for a down payment with no tax implications. In addition, any funds not used towards a home purchase can be transferred to an RRSP or a RIFF penalty-free and tax-deferred,” says Brock. “I absolutely recommend it because it incentivizes first-time home buyers to save even more money.”

Who is eligible?

To open an FHSA, you must:

Be an individual resident of Canada

Be at least 18 years of age

Be a first-time home buyer, which means you, or your spouse or common-law partner (“spouse”) did not own a qualifying home that you lived in as a principal place of residence at any time in the year the account is opened or the preceding four calendar years.

Every little bit helps.

On April 1, 2023, saving for a down payment is going to get a little bit easier for prospective first-time home buyers, 18 and over. The Tax-Free First Home Savings Account (FHSA) lets first-time home buyers save up to $40,000 tax-free. Even better, if you're coupled up, you can both start saving for that white picket fence dream. So grab your savings jar (or old piggy bank) and get ready to make your down payment dreams a reality.

Alphabet soup.

So how does the FHSA differentiate from other savings plans, such as a TFSA, RRSP or the Home Buyers’ Plan (HBP)? CPA Canada’s Vice President, Tax Department, Bruce Ball, explains it like this: “Like registered retirement savings plans (RRSP), contributions to an FHSA will be tax deductible. Like tax-free savings accounts (TFSA), income and gains in your FHSA, as well as withdrawals, will be tax-free.”

Ball went on to explain that with the current HBP, you can withdraw up to $35,000 from your RRSP, then pay back the funds to your RRSP over 15 years. However, with an FHSA, unlike the HBP, the funds do not need to be paid back. That’s a lot of savings in your pocket. Keep in mind, the maximum amount you can contribute to your FHSA is capped at $8,000 a year to a maximum of $40,000 over a 15-year lifetime term.

Pay it forward.

Like an RRSP, you can carry forward unused contribution room in your FHSA up to $8,000 of your unused annual contribution amount to use in a later year. For example, if you open an FHSA in 2023 and contribute $5,000, you can contribute up to $11,000 in 2024. Carry-forward amounts do not start accumulating until after you open an FHSA.

Trade your heart out.

As far as what you can invest into your FHSA, it is the same as for TFSA - mutual funds, publicly traded securities, government and corporate bonds, and guaranteed investment certificates.

The best choice of savings plans to choose from depends on different factors, such as timing and the potential amount that will be saved. The withdrawals under both plans (HBP and FHSA), can be made tax-free, but since you will have to repay the HBP withdrawal, it appears to make sense to contribute to an FHSA first. According to Ball, if savings are available after FHSA contributions, then making contributions to an RRSP with a view to later use the HBP may be the preferred option.

“Before making additional RRSP contributions to fund future HBP withdrawals, consideration should also be given to using a TFSA to save money beyond the FHSA,” says Ball. “Where a choice must be made as there will be insufficient savings to do both, you’ll need to consider the benefits of each alternative. Although TFSAs are not specifically designed for first-time home savings, these plans are worth considering for several reasons.”

The fine print.

When it is time to purchase your home, Ball says: “You must have a written agreement to buy or build a qualifying home before October 1 of the year following the year of withdrawal, and you must intend to occupy the home as a principal place of residence within one year after buying or building it.”

Benjamin Brock, RBC senior financial planner agrees, adding: “You have to buy a home within that 15-year window or until the end of the year you turn 71 years old. Individuals will be able to claim an income tax deduction for contributions made in a particular taxation year. The FHSA is a great option, as it achieves a few goals that didn’t exist before.”

Welcome to the neighbourhood.

Brock believes that this news is a welcome incentive given Vancouver’s housing prices have been rising for years, while average incomes have been lagging behind inflation rates, presenting an affordability crisis in which many young people struggle to save up enough for a down payment.

“The FHSA is an easy way for prospective home buyers to save money for a down payment with no tax implications. In addition, any funds not used towards a home purchase can be transferred to an RRSP or a RIFF penalty-free and tax-deferred,” says Brock. “I absolutely recommend it because it incentivizes first-time home buyers to save even more money.”

Who is eligible?

To open an FHSA, you must:

Be an individual resident of Canada

Be at least 18 years of age

Be a first-time home buyer, which means you, or your spouse or common-law partner (“spouse”) did not own a qualifying home that you lived in as a principal place of residence at any time in the year the account is opened or the preceding four calendar years.

Original article from rew.ca