Unless you started a sourdough empire during the pandemic, getting a mortgage is an important step on the road to buying a home. On the journey, you might find yourself lost in a sea of questions and terms you’ve never heard before. That’s where this roadmap comes in. We’re here to put on our guide hats and break down what you should know before getting a mortgage, from payment frequency to terms-and beyond. Read this before you reach out to a mortgage broker to give yourself the right footing.

Setting up camp.

Your first consideration when getting a mortgage is pretty straightforward: Are you ready for this? We created a guide to help you get to the bottom of this question and sort out any existential crises or anxiety that may come to the surface when exciting topics like “amortization” come up. Use it wisely. Let this also act as your heads-up that we will be discussing amortization later. You’ve been warned.

Letting the air out.

Now that we’ve got that out of the way, let’s talk about interest rates.

Unless you’re particularly good at avoiding the news, you’ve likely heard stories about interest rates rising recently. Canadian rates have been at historic lows throughout the pandemic, but a battle with inflation has pushed the Bank of Canada to raise interest rates back above pre-pandemic levels. In the context of getting a mortgage, this means the rates offered to you right now are going to be higher than they were in previous years.

The run up.

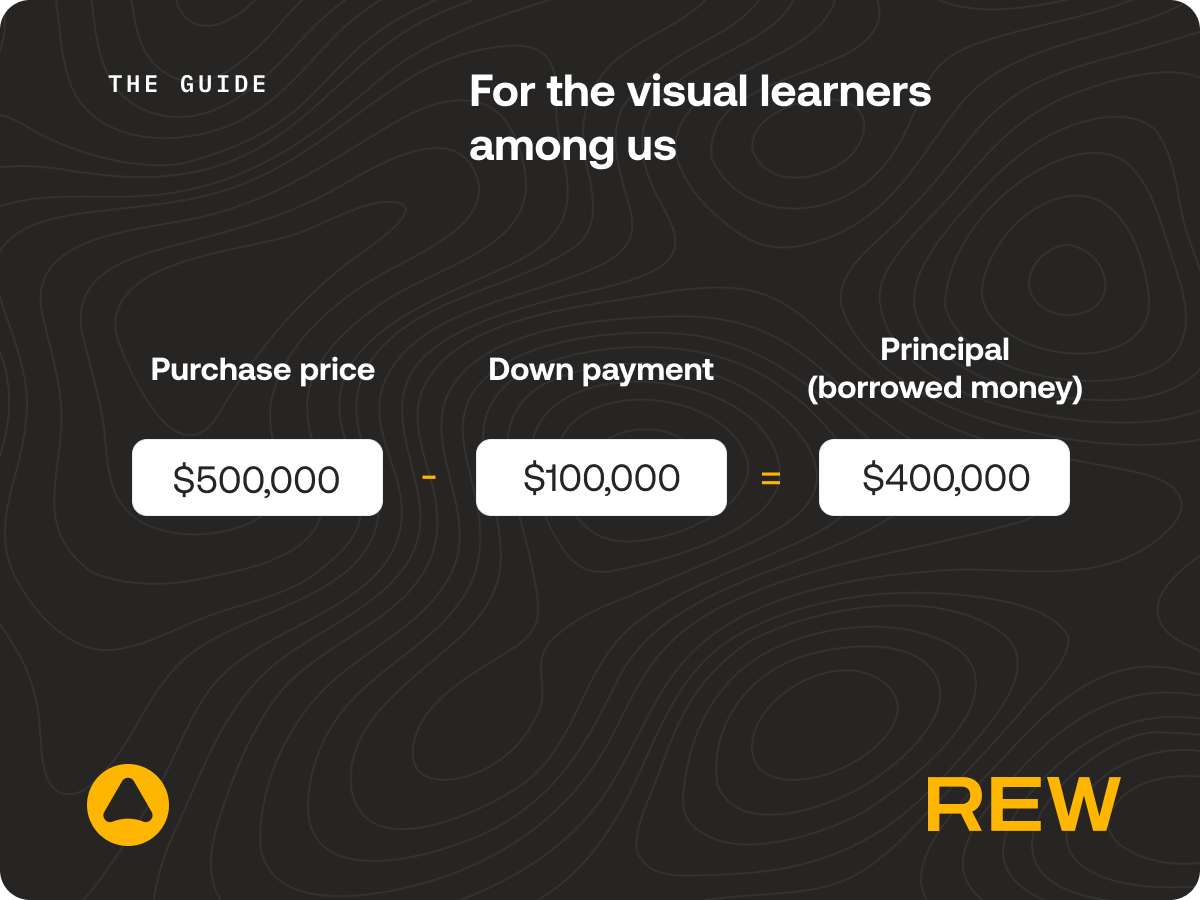

To be approved for a mortgage, you may need to meet qualification requirements, including passing a stress test, and you’ll need a down payment. The amount you end up borrowing from a lender is called the principal, which you can determine by taking the purchase price of your home and subtracting the down payment.

If you put down less than 20% of the purchase price of your home, you’ll need to tack a mortgage insurance premium onto your loan. Keep in mind that for homes worth over $1,000,000, a 20% down payment is required (this isn’t Florida in 2008). If any of this has you wondering why on earth you would buy real estate in Canada, good news. We have a guide for that, too.

Here are some of the other factors you should take into consideration when shopping for a mortgage.

Terms of endearment.

Your mortgage term is the length of your contract with a lender. Terms typically range between one and ten years, and the length you sign up for will impact your interest rate. You can always view today’s rates at REW.money.

Most Canadians opt for a short-term mortgage, which is defined by the government of Canada as a five-year mortgage or less. Mortgages with these terms typically have lower interest rates than long-term mortgages (terms of more than five years), and as you can imagine, they have to be renewed more frequently. Long-term mortgages also tend to have larger penalties should you sell your home within the first five years of your term, so make sure you’re in it for the long haul if you’re thinking about a long-term mortgage.

The long and short of it.

This leads us to an important difference between short and long-term mortgages: long-term mortgages are fixed rates only, meaning that when you choose this mortgage, you’re locking in at a specific interest rate for the entire term. This can be good for you if rates rise and bad if rates fall. The major benefit is that your payments are predictable.

Short-term mortgages can be locked in at fixed interest rates, but they also offer borrowers the ability to sign up for a variable rate.

Variable rates, as the name suggests, can change during the course of your term. If rates go down, your rate will go down with a variable-rate mortgage. The same is true if rates rise. They’re typically a bit cheaper than fixed rates and can be structured in a few ways.

The two most common are fixed payments with a variable rate, and adjustable payments with a variable rate. The former keeps your payments the same when rates change (and you pay more or less towards your interest), while the latter will have your monthly payments slide up or down.

Here are some of the other factors you should take into consideration when shopping for a mortgage.

Terms of endearment.

Your mortgage term is the length of your contract with a lender. Terms typically range between one and ten years, and the length you sign up for will impact your interest rate. You can always view today’s rates at REW.money.

Most Canadians opt for a short-term mortgage, which is defined by the government of Canada as a five-year mortgage or less. Mortgages with these terms typically have lower interest rates than long-term mortgages (terms of more than five years), and as you can imagine, they have to be renewed more frequently. Long-term mortgages also tend to have larger penalties should you sell your home within the first five years of your term, so make sure you’re in it for the long haul if you’re thinking about a long-term mortgage.

The long and short of it.

This leads us to an important difference between short and long-term mortgages: long-term mortgages are fixed rates only, meaning that when you choose this mortgage, you’re locking in at a specific interest rate for the entire term. This can be good for you if rates rise and bad if rates fall. The major benefit is that your payments are predictable.

Short-term mortgages can be locked in at fixed interest rates, but they also offer borrowers the ability to sign up for a variable rate.

Variable rates, as the name suggests, can change during the course of your term. If rates go down, your rate will go down with a variable-rate mortgage. The same is true if rates rise. They’re typically a bit cheaper than fixed rates and can be structured in a few ways.

The two most common are fixed payments with a variable rate, and adjustable payments with a variable rate. The former keeps your payments the same when rates change (and you pay more or less towards your interest), while the latter will have your monthly payments slide up or down.

There are hybrid, combinations and other kinds of mortgages you can also consider. Speak to a professional to learn about all the options.

Payday.

It’s not just how much you pay, it’s also how often you pay. When you select a mortgage, you can choose to make payments over the following schedules.

Here’s the key takeaway when it comes to payment frequency: your mortgage will be paid off sooner if you increase the payment frequency and amount. You’ll reduce the principal faster and pay less interest if you go this route.

The time of your life.

The amortization period is the amount of time to pay off your entire loan. The longer your amortization period, the lower your payments will be. However (and this is important, so listen up), a longer amortization period also means a lot more of your hard-earned money goes towards interest payments.

Note: The maximum amortization period for a home with a down payment of less than 20% is 25 years.

If all the above is new to you, give this guide a readthrough one more time. This is important information that’s going to give you a solid understanding of things to consider when applying for a mortgage. Once you’re at the point where you’d feel comfortable explaining the key points of this guide to a past version of yourself, make the call and start a conversation about money with a trusted expert.

Payday.

It’s not just how much you pay, it’s also how often you pay. When you select a mortgage, you can choose to make payments over the following schedules.

Here’s the key takeaway when it comes to payment frequency: your mortgage will be paid off sooner if you increase the payment frequency and amount. You’ll reduce the principal faster and pay less interest if you go this route.

The time of your life.

The amortization period is the amount of time to pay off your entire loan. The longer your amortization period, the lower your payments will be. However (and this is important, so listen up), a longer amortization period also means a lot more of your hard-earned money goes towards interest payments.

Note: The maximum amortization period for a home with a down payment of less than 20% is 25 years.

If all the above is new to you, give this guide a readthrough one more time. This is important information that’s going to give you a solid understanding of things to consider when applying for a mortgage. Once you’re at the point where you’d feel comfortable explaining the key points of this guide to a past version of yourself, make the call and start a conversation about money with a trusted expert.

Original article from rew.ca